Agyapa Royalties deal

The Agyapa Royalties transaction is still raging on after some three weeks of public outcry against the deal.

The unending saga is mainly because the content and character of the offshore Agyapa Royalties company is shrouded in secrecy; and the fact that the off-shore company is incorporated in tax haven Jersey, in the Canary Isle, UK.

These are the inherent problems that have brought a lot more confusion even at the formative stage of a company, which operation is expected to start in 2021. As it stands, no one, perhaps except those involved in the establishment of the company, is aware of the shareholder and the directorship structure of the company.

The other shocker is why the company was incorporated in a country which is tax-free? If these are the limitations bugging commodity experts and others; then be prepared to read a further shocker and a hidden truth in the Agyapa deal.

A further hidden truth in the Agyapa Royalties deal

Perhaps you would wonder why the Attorney General’s Department kicked against the deal when it first became public. These are the reasons: Agyapa Royalties hired a private legal firm, Africa Legal Associates to help create and establish the legal regime defining the operation of the Company both in Ghana; and the Jersey Isle.

The majority shareholder in Africa Legal Associate is Gabriel (Gabby) Otchere-Darko, a cousin of the Ghanaian President, Nana Addo Danquah Akufo-Addo. With the parent entity that ceded 49 percent of shares to Agyapa, being created as a wholly Ghana Government owned company, the Attorney General was by law, entitled to a representation on all deliberations and discussions preceding any contractual agreements between Ghana and the offshore Agyapa Royalties Company.

The Attorney General’s Department was represented by Godfred Dame, the deputy Attorney General who reported any such proceedings to his boss, Ms. Gloria Akufo, anytime there was the need for Dame to do so. In one of the deputy Attorney General’s briefings of her boss, Gloria Akufo rejected aspects of the Agyapa deal, which in her estimation, was a disadvantage to Ghana.

She therefore directed that he (Dame) went back to the brokers to factor in the agreement, the concerns that she (Gloria Akufo) had raised. The Attorney General thought a company that is acting as a vehicle that will help broker Ghana’s Gold Royalties within such an inconclusive duration should be more transparent.

That is to suggest that shareholders and directors of the company should be made public; look again at the $1billion seed money that Agypa wants to pay for all of the country’s Gold Royalties and more importantly; the fact that Agyapa Royalties would be taking over the country’s Gold Royalties in perpetuity.

Deputy Dame then goes to relay the concerns raised by his boss to African Legal Associates, the private company crafting and handling legal matters concerning Agyapa Royalties and its intended job in Ghana’s mining sector. The assurance was given by lead shareholder of African Associates, Gabby Otchere Darko that all the issues raised by the Attorney General would be taken care of in the final draft that would be presented to Parliament for approval.

The President of the Republic and the Chief of Staff, Madam Frema Opare were all kept in the loop of the concerns raised by the Attorney General and the assurances thereof given by Africa Legal Associates that the AG’s red-flag would all be dealt with to ensure that Ghana gets real value in the transaction.

Shockingly, the concerns of the Attorney General were not factored in the final draft as assured by Gabby Otchere-Darko and his team. The logical question then became what might have motivated the unwillingness on the part of Africa Legal Associates to consider into the final draft, what the Attorney General had insisted should be done in the agreement.

The Attorney General then reported the conduct of Gabby and his team to the Chief of Staff, who also informed the President about the development. That also explains why the Attorney General criticized the deal right at the onset. Later attempt by the AG’s office to offer some form of legitimacy to the deal was therefore an after-thought.

The AG needed to safe her Government, whose trolling in the Agyapa Royalties deal is causing so much embarrassment and the potential of landing the government in opposition. There is also the matter of aside Otchere- Darko, how another relative of the President is also benefitting from the deal.

Finance Minister, Ken Ofori Atta, also cousin of the President has his financial institution, Databank, as the Investments Bank handling all financial transactions concerning the deal. There is also Kofi Osafo Maafo, the son of Senior Minister, Yaw Osafo Maafo, as the CEO Agyapa Royalties. He is said to have played a lead role in convincing the Ghana Government about the benefits Agyapa Royalties are likely to bring to Ghana’s mineral sector, specifically, Gold expropriation.

What is Agyapa Royalties Deal Company Limited?

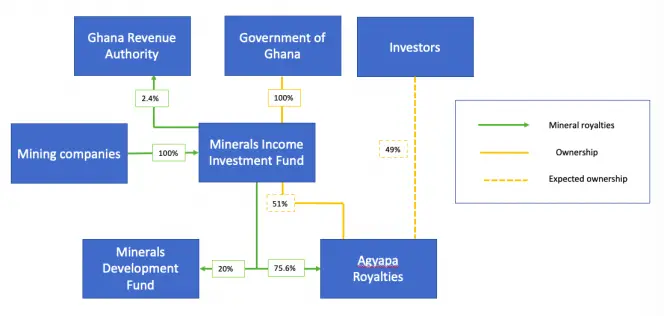

Agyapa Royalties, formerly Asaase Royalties is a Ghanaian Government Company created through the Minerals Income Investments Fund (MIIF) to receive funds/monies Ghana will be earning from her Gold Royalties.

In exchange, Agyapa Royalty will be raising between $500,000 to $1billion for Government on the Ghana & London Stock Exchange to help drive government’s infrastructural development agenda. In other words, the agreement will enable Ghana use a Special Purpose Vehicle Agyapa Royalties, to secure the stated funds through shares in Ghana and the UK.

The agreement, according to Government, is in line with the Minerals Income Investments Fund (MIIF) Act 2018 that offers Agyapa Royalties the legal backing, to act as the vehicle to collect Ghana’s Gold Royalties; to seek for more monetary value on it at both the London and Ghana stock exchange.

What’s stated in the Agyapa Royalties Agreement?

According to the agreement, 75.6% of Royalties payable to Government over the life-span of a number of mining concessions are being assigned to a Jersey Incorporated Company and its Ghanaian affiliates. The Jersey Isle is one of the Island countries in the English Channel.

Jersey is a tax haven where it offers its residents a 0% corporate tax and low income tax rates due to its attractive investment environment. Jersey has become a popular destination for high-net-worth individuals aiming at maximizing their tax liability. Agyapa Royalties is situated at the 3rd Floor, 44 Esplanade; St. Hilier, Jersey, JE49, WG in the British Isle.

The Jersey offshore company will initially be a wholly-owned Government entity; that will, as reported sell 49% of its shares in Agyapa Royalties for $500million or a maximum of $1billion. Thus Government’s right to Ghana’s Gold Royalties covering all known mines and other prospective ones are being assigned to Agyapa for an indefinite future; in other words, in perpetuity.

Under the agreement, Agyapa’s rights will continue beyond the duration of any leases granted to the mining companies. Agyapa is legally strengthened by a mandated clause that compels the concessionary companies to renew their lease agreements with parent group-Agyapa. According to concessionary experts, the maximum duration of mining lease is thirty years, meaning after the limited duration, Agyapa will still have the rights to negotiate further Royalties rights of the leased mining companies.

It’s therefore difficult to fathom the basis on which these rights have been valued at $500m or by extension, $1billion. Gold experts believe the agreed fee should increase further when a right to Royalties period is extended or the period for the mining lease is renewed. Therefore, the logical question among many Gold miners is that under the circumstance, Ghana will be/is short-changed if we should be earning same as when the Royalties rights/fee were entered into with the mining concessioners.

Ken Ofori Atta on Agyapa Royalties deal matters in the media

Speaking on the subject at a press briefing Friday, August 28th, 2020, Finance Minister, Ken Ofori Atta, failed to speak on any of the pressing issues that are bothering Ghanaians in the agreement, including his own Databank, and instead dwelt more on what benefits Agyapa Royalties brings to the country.

He also appeared jittery and elusive on other media platforms that he had spoken on the subject and even went into overdrive by questioning why the President of the National House of Chiefs could question and call for transparency in the deal. According to the Finance Minister, Agyapa Royalties provides Government with the opportunity to use innovative ways to manage and maximize the country’s mineral wealth.

He further noted that the current arrangement where the value multinational companies in Ghana’s extraction industry are assessed by basic indicators such as taxes, ignores many of the different ways in which the countries that extract the resources utilize their rights beyond and outside of our borders as a means of creating value.

In the current arrangement, he argued, Ghana gets ahead of the queue in adopting similar approaches to maximize the country’s wealth potential adding “this desire to domesticate or expectations when operating in the global market only adds to hurt and limit developing economies”.